Delayed Client Due Diligence (CDD)

Normally, client identification and verification must be completed before starting work. However, with Compliance Officer approval, work may proceed before completing these steps if the following conditions are met:

- The client has been identified.

- Commencing work is necessary to prevent disruption to normal business operations.

- There is minimal risk of money laundering or terrorist financing.

- Money laundering and terrorist financing risks are managed effectively through transaction limits and account monitoring.

- The client and/or matter risk assessment has been completed.

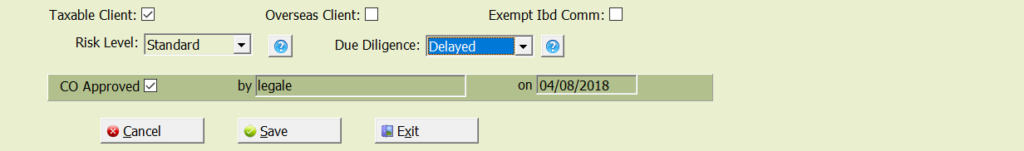

The DELAY process involves completing the CRA, setting the client DD level to DELAYED, and obtaining approval from the firm’s Compliance Officer.

Note: Restrictions may apply to transactions for DELAYED clients. For example, client funds cannot be disbursed until AML requirements for the client are fully completed.

Set a Client to Delayed CDD using Client Maintenance

Open the client record using the Client Maintenance app.

Complete the CRA – read more here about this process Client Risk Assessment – LegalOffice User Guides

Next, set the Due Diligence level to DELAYED. Identification information does not need to be entered at this stage.

Click Save before exiting client maintenance to ensure the CRA record and CDD level is properly saved and created.

The client will now appear in the AML Manager program, ready for Compliance Officer approval.