Mortgage manager now contains a file export function for the IRD Upload service enabling payers to send investment income information directly to the IRD for a specific reporting period.

You can read what the IRD has to say here https://www.ird.govt.nz/digital-service-providers/services-catalogue/returns-and-information/investment-income-reporting/investment-income-reporting-file-upload-services

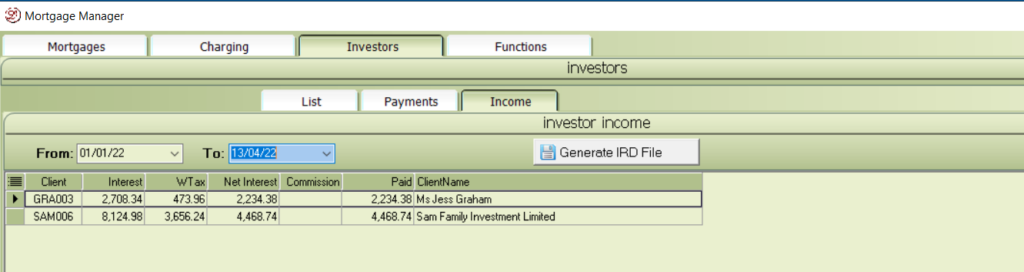

Open the Mortgage Manager / Investors / Income tab and set the Income period you wish to report on.

Use the Generate IRD File button to produce a file for RWT and a file for NRWT if there are any.

The files generated when the Generate IRD File button are CSV files named “MTG RWT file for IRD YYYYMMDD” for RWT and “MTG NRWT file for IRD YYYYMMDD” for NRWT where YYYYMMDD is the end date of W/Tax period.

Open the IRD portal and import the RWT information from the files created and saved to your RwtFileFolder

Configuration

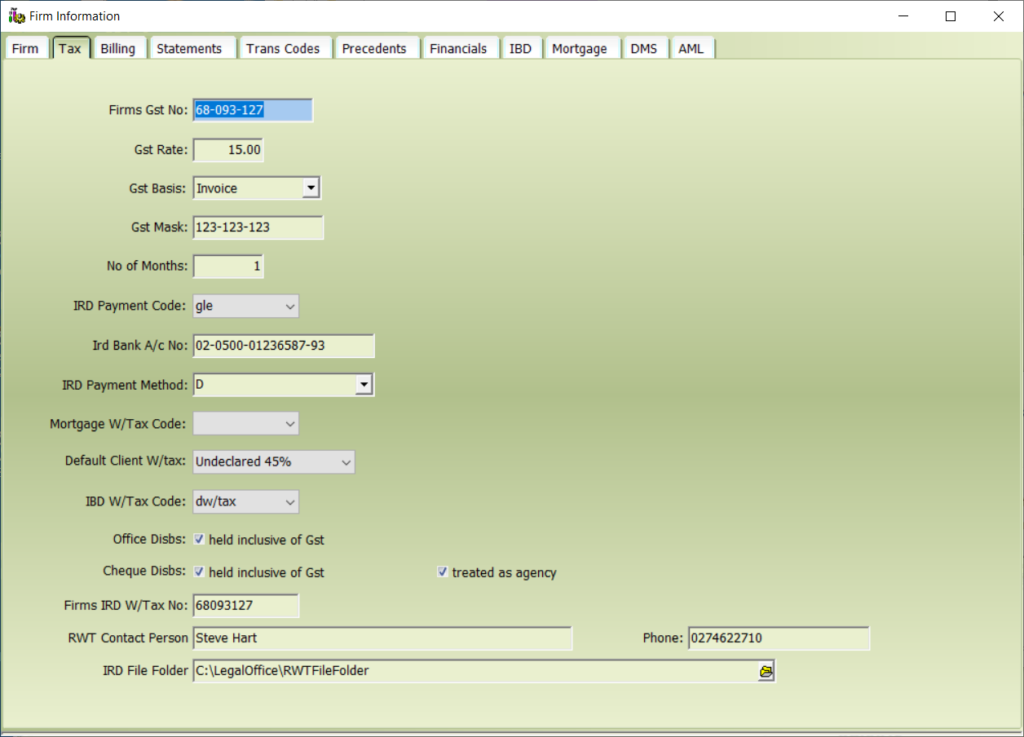

You can configure this facility using Control File Maintenance app – Tax tab

- RwtNo – this is the firms W/Tax no IRD No – 9 digits no spaces or “-“s.

- RwtPerson – the Contact person in the firm that deals with W/Tax.

- RwtContactPhone – the phone no of the Contact Person above.

- RwtFileFolder – the folder where the csv files are to be created.

For NRWT clients, the IRD needs a country of residence code as per their codes table. To enable this, use the Tax Country of Residence field located in the Identity file. Use the drop down list to select the correct country code as this needs to be exact and consistent with the IRD codes..

Identity Residency Country status is added and maintained using the Identity Maintenance app. Read more about Identity Maintenance here