To set up and activate a mortgage in LegalOffice, follow these key steps:

- Create the Mortgagor client and matter

- Create the Mortgagee client and matter

- Create the Mortgage record

- Create the Mortgagee record

- Fund and activate the mortgage

1. Creating the Mortgagor and Mortgagee Clients and Matters

Use the Client Maintenance and Matter Maintenance apps to set up both the mortgagor and mortgagee records.

For the Mortgagee matter, ensure the following configurations:

- Matter Number: Set to MGEE

- Matter Type: Set to Mortgagee

- Payments Section: Configure this to reflect the method and bank account used for receiving interest and capital repayments

- Auto Payments: Tick this option if you want repayments to be included in the automated mortgage payment run process

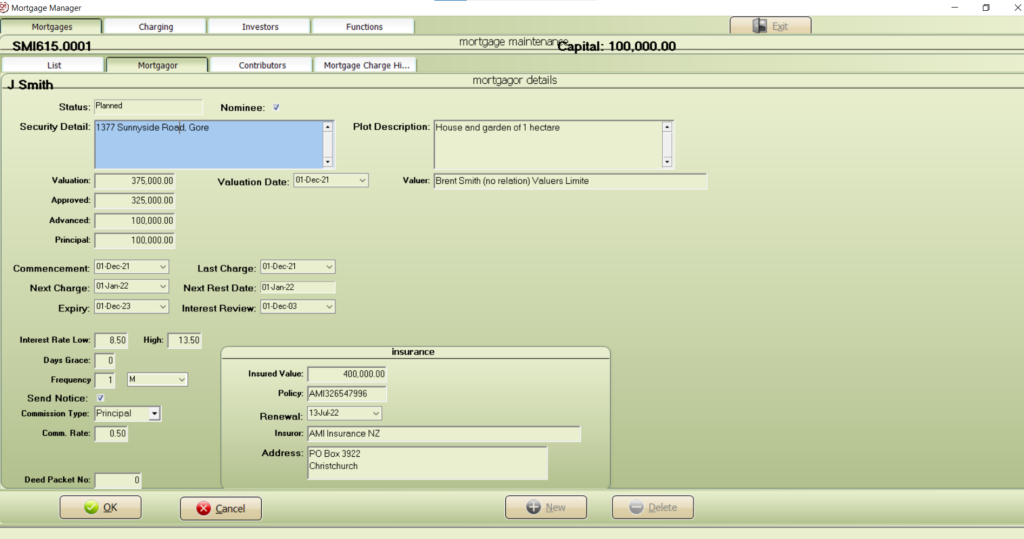

Creating a mortgage record

Open Mortgage Manager and click NEW to create a new mortgage record.

Use the following table when completing the mortgagor set up;

| Field | Description |

| Status | indicates the current status of the mortgage. You can change this status but generally this is managed by the system |

| Nominee | indicates whether it is a nominee or contributory mortgage |

| Security Detail | record a description of the mortgaged property. This is generally the property address |

| Plot description | record the legal title of the mortgaged property |

| Valuation | record the valuation amount of the mortgaged property |

| Valuation Date | record the date of the valuation used when issuing the mortgage |

| Valuer | name of the registered valuer |

| Approved | amount approved for the mortgage |

| Advanced | amount advanced to the mortgagor |

| Principle | amount of the mortgage outstanding |

| Commencement Date | date at which interest starts to be charged |

| Last Charge Date | displays the last charge date for the mortgage |

| Next Charge | displays the next charge date for the mortgage |

| Next Rest Date | A system date used to calculate interest and commission |

| Expiry | record the mortgage expiry date. This can be altered manually as required and reported on |

| Interest Review | record the next interest review date. This can be altered manually as required and reported on |

| Interest Rate Low | record the rate of interest used to calculate the standard interest charge to the mortgagor |

| Interest Rate High | record the rate of interest used to calculate any penalty interest charge to the mortgagor |

| Days Grace | record the number of days a mortgagor may be late in paying the mortgage interest before penalty is charged |

| Frequency | record how often mortgage interest is to be charged. This can be any number of days, weeks or months |

| Send Notice | when selected, an interest notice will be generated when the mortgage is charged |

| Commission Type | record the % rate used to calculate the commission charged to the mortgagor. Can be calculated on the principle or interest, be a fixed amount or be none |

| Insurance | record the insurance details. This can be altered manually as required and reported on |

Click OK to save your mortgagor record. Note that you can change and edit this record at any time.

Create the mortgagee record

Switch to the Mortgage Contributors tab and click NEW to add the investors into to your mortgage

Use the following table when completing the mortgagor set up;

| Field | Description |

| Sum Advanced | record the amount being invested in this mortgage by the Mortgagee |

| Invested | record the amount advanced to the mortgagor |

| Date In | record the date the investment is being made and when interest commences being charged |

| Date Out | record the date the investment was withdrawn |

| Interest Rate Low | record the rate of interest charged for interest paid to the mortgagee |

| Interest Rate High | record the rate of interest charged for penalty interest paid to the mortgagee |

| Commission Type | record the % rate calculating commission charged to the contributor. This can be calculated on the principle or interest, be a fixed amount or be none |

| Authority Held | record you have authority from the investor to make this investment |

| Authority Expiry | record the expiry date of the authority |

Fund and Activate the Mortgage

The Mortgage Manager is now ready to post the journals which fund the mortgage.

Switch to the Mortgagor tab, right mouse click on the ‘Status’ field and select ‘Fund and Activate’.

The status will change to new and journals transferring funds between the mortgagee and mortgagor will have been completed.

The mortgage is now set up and ready for ongoing processing.