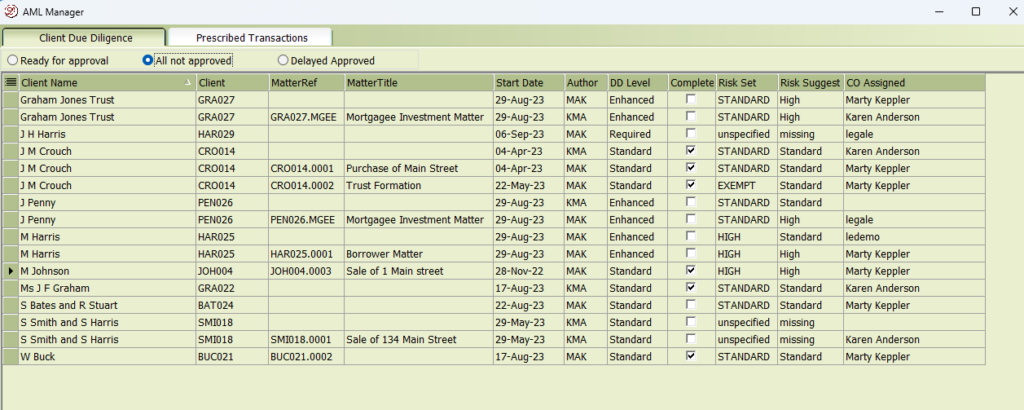

The AML Manager app is used by the firm’s compliance officers to confirm a client or matter has had the necessary AML checks completed.

All clients and matters that have not been approved can be displayed by clicking the ‘All not approved’ box.

Each record will display information allowing you to determine how far in the AML process the individual client or matter has gone.

Each new client and new matter must be individually approved. Once the client has been approved, then only future matters will require approval.

Note that if an approved client or matter has its AML status changed, it will need to be approved again.

What is the grid data is telling me?

The standard client name, author, client number, matter reference and title fields will display for each record. Records with no matter reference relate to a Client only. those records with a matter reference related to that specific matter.

For the other fields;

| Start Date | The date the client or matter was opened |

| DD Level | The due diligence level set for the client |

| Complete | Indicates the client or matter record’s AML process is complete and therefore ready for approval |

| Risk Set | Indicates what risk level has been given to the client or matter record. |

| Risk Suggest | Indicates the system suggested Risk level based on the completed risk analysis form. Note: This can be different from the Risk Set field value and this being different would indicate the author has used their own judgement to set the matter with a different status level. |

| CO Assigned | Optional feature for firms wanting to assign a specific compliance officer to a client or matter record. |

How do use this this information and approve a client or matter?

It isn’t unusual for the ‘Not Approved’ tab to contain a long list of records, the nature of AML data collection means it can take some time to complete the process.

The AML system allows staff to complete the data collection process over time and then to mark the record as being ready for approval. This saves the compliance officer from having to review records that are not yet ready for approval.

Approving clients and matters

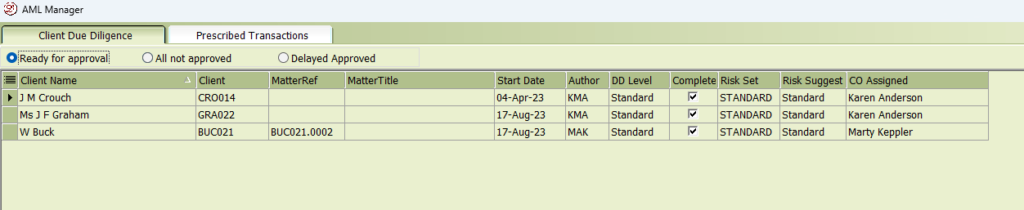

The tab ‘Ready for Approval’ is the best list to work from when approving clients and matters as this tab only displays clients and matters where staff have indicated they have completed the data collection process.

Consider the above record for CRO014;

- this is a client requiring approval as there is no matter reference shown.

- the ‘DD Level’ is set as Standard indicating the client is deemed not to require any special due diligence checks.

- the complete box is ticked meaning the data entry staff believe they have completed what needs to be done. This includes recording personal information like DOB, contact information and collection of ID verification documents.

- the Risk Set field is showing Standard indicating the risk assessment of the client found nothing of concern.

- the Risk Suggest field is showing Standard indicating the risk assessment questionaire found nothing of concern. Note this field value can be different to the Risk Set field, if it is different it would indicate the staff have decided to use their judgement and set the client differently to what the system considers the risk.

- the CO Assigned field is only used when you have multiple compliance offices and indicates which officer is dealing with the client or matters approval.

Approving the client

A function of the compliance officer is to verify the client data collection and risk assessment are true and accurate. To check a client;

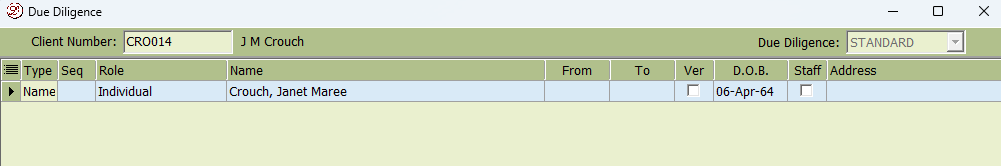

- right click on the record and select Client Due Diligence.

- this displays the CDD information screen and shows the Identities you are dealing with in respect of this client. These identities are considered to have decision making abilities and control of the Client.

A client can have multiple identities listed e.g. a joint client may have 2 or more identities. A company may have the same with directors and shareholders listed, a Trust may have trustees and beneficiaries. You need to approve each Identity before you can approve the Client.

- right click and select Edit identity.

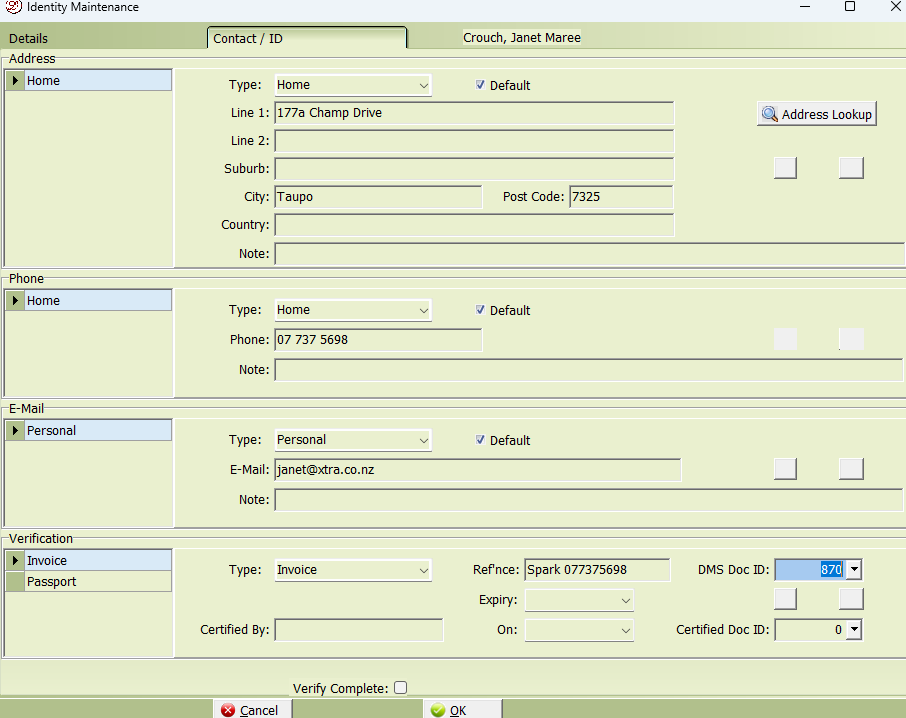

- this app displays all information relating to the identity.

- the details tab shows any personal information you have collected like DOB, IRD and Bank account numbers.

- the contact tab shows all contact information like address, email and phone details and ID verification documents.