Use the The IBD Manager app to manage and process IBD ledger transactions.

Reference Allocation

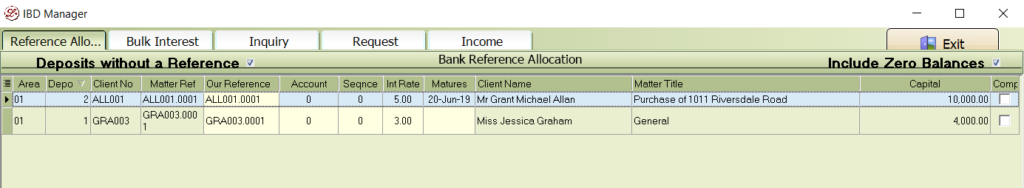

All Matters that have had an IBD deposit are displayed on this tab and this is where you can maintain a matters IBD bank reference and account number.

When a new IBD deposit is created at your bank, a reference is applied to that IBD account. Legal Office uses this reference to identify the matter relating to the deposit being held. The reference held at the bank should be loaded against the Legal Office deposit record when you post the opening deposit transaction.

To amend or add the deposit reference, select the ‘Reference Allocation’ tab, locate the appropriate deposit and add the reference into the ‘Our Reference’ field.

Bulk Interest Processing

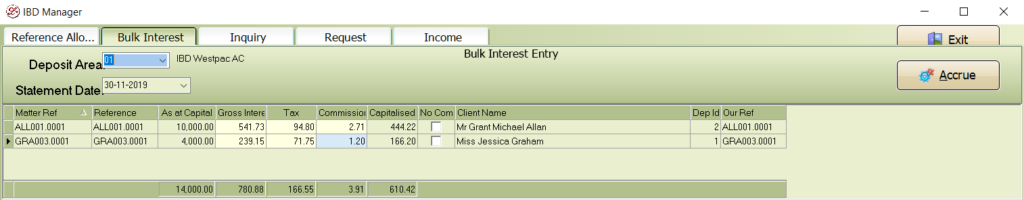

The bulk interest tab is where you record interest accruals for IBD investments. You can either manually add the interest accruals or import the interest records directly from your bank.

Manually adding interest records

Select the deposit area code and enter the accrual date. Right mouse click on the empty grid and select ‘New Worksheet’ from the menu displayed.

A record for all matters with an IBD deposit balance @ the accrual date will display.

Enter the gross interest value from your banks ‘IBD Sundry Interest report’

The app will attempt to calculate the correct tax and commission amounts due however, these can be amended if required.

The totals displayed on screen should equal those on the report.

When you have finished adding your interest records and confirmed the totals are correct, select the ACCRUE button to post the interest.

Import interest records directly from your bank

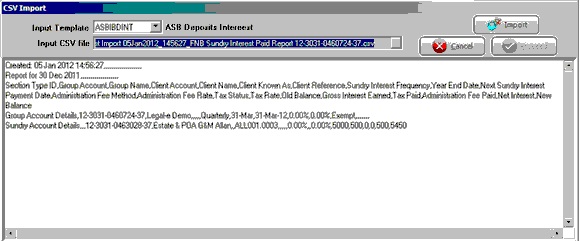

The import function can be used to import IBD interest accruals received from the bank. Most commonly it is used for Monthly and/or Quarterly Accruals.

From your internet Banking interface, export the ‘Sundry Interest Paid Report’. Run the report selecting the required closing date e.g. 30/09/2011. Save this file to an accessible location.

Open IBD Manager and switch to the Bulk Interest tab. Select the correct deposit area and required date. Right mouse click on the main records panel and select ‘Import from CSV’.

Select the Input Template for your bank e.g. ASBIBDINT for ASB customers and then locate and select the csv file saved earlier. Select Import and wait for the program to complete loading of the file. Select the Proceed button to load the interest records into the bulk interest program. Once this process is complete you will be taken to the Bulk Interest tab and the loaded records will be displayed.

After the interest has been loaded, if required you can maintain the individual interest records. The first thing to check is that the total values for the records loaded are equal to the ASB Bank Interface report for the period concerned.

Ensure all records have a matter reference allocated. Any records that do not have a matter reference will display in red and indicate Legal Office could not match the bank reference to the matter. To locate and apply the correct matter reference, right mouse click on the deposit record and select ‘Assign Deposit’. Select the correct matter from the list displayed. Legal Office will automatically update the bank reference for this deposit which means any future interest accruals for this matter will be recognized correctly.

When complete all records will have a matter reference and the displayed totals will agree with the bank report.

To update and post the interest to your matters, select the ‘Accrue’ button.